Researchers predict a 'generational' dive in housing demand and say it could cause a major price downfall.

By Lew Sichelman, United Feature Syndicate

February 10, 2008

WASHINGTON -- The common perception among economists is that the current housing mess will be a relatively short-term affair that should see a return to normalcy within the next few years.

But, according to a new study by two USC researchers, problems of greater proportion lie just ahead. They call it the "generational housing bubble" and maintain that it will be fueled by the same baby boomers who have been bidding up prices since 1970 as they moved up the housing ladder.

Now, 78 million boomers are about to enter their twilight years when homeowners tend to become sellers rather than buyers. And as a result, the USC duo expects there will be "many more homes available for sale than there are buyers for them."

As the elderly become more numerous than the young, and shift into seller mode, the researchers postulate, the market imbalance could come quickly around 2011, causing housing prices to fall.

Only time will tell whether the projections by Dowell Myers, a professor of urban planning and demography in USC's School of Policy, Planning and Development, and Sungho Ryu, a doctoral candidate at the school and an associate planner with the Southern California Assn. of Governments, will come to pass.

After all, not all seniors retire or sell their homes and move to smaller places. Many prefer to age in place and live in their own homes. But eventually, as they die off, most of their homes will come on the market.

Myers and Ryu's foreboding prophecies bring to mind a 1989 study by a pair of Harvard economists, who predicted a 47% decline in housing prices during the 1990s because boomers would stop buying as they aged. Housing-industry economists lambasted that forecast as pure poppycock, and it eventually went up in smoke.

The USC researchers don't expect the generational correction to begin until 2011 or so. That's just about the time the most pessimistic prognosticators suggest the U.S. market will return to normal after five years or so on the rocks.

But it's also when the first wave of boomers reaches age 65, the traditional dividing point between seniors and working adults. And once that tipping point is reached, Myers and Ryu say, they will put more houses up for sale than the market will be able to absorb.

The researchers base much of their theory on the historic relationship between age and housing demand. For most of the American life span, the rates of buying and selling remain closely related because those who sell one house typically buy another. When people enter their late 50s and early 60s, as the leading wave of baby boomers has now done, buying and selling are in balance. When they reach their mid-60s, though, sellers start to outnumber buyers. And when they hit their 70s, sellers dominate.

People continue to buy homes after that age. But once they hit that benchmark, the number of sellers begins to exceed the number of buyers. Once they reach 75, they are three times as likely to be sellers than buyers. And at 80 and above, they are nine times more likely to be sellers.

Myers and Ryu project that the ratio of those age 65 and over to people ages 25 to 64 will surge 30% in the decade between 2010 to 2020 and 29% more in the 2020s, altering the balance between buyers to sellers for the foreseeable future.

They say the supply of houses on the market will be dominated by the actions of aging homeowners "who have little ability to postpone" their need to sell and retire from the housing market. They also caution that boomers facing age-related issues "could flood the market with excess supply."

If values decline, as the researchers suspect they will, boomers who remain owners will suffer because their equity will fall, shrinking what for many is their retirement savings.

If there is a positive aspect to Myers and Ryu's dire predictions, it's that the coming generational bubble will be a rolling one that won't affect all housing markets at the same time. And in some states, the sell-off will come later rather than sooner. Regional differences may be sharp.

Historically, seniors don't become net sellers in Arizona, Florida and Nevada until they reach 75. But the opposite is true in 13 other states -- Alaska, California, Connecticut, Illinois, Indiana, New Jersey, New York, Maryland, Massachusetts, Michigan, Minnesota, Ohio and Rhode Island. In those states, the crossover starts at age 55.

Lew Sichelman can be reached at lsichelman@aol.com.

Monday, February 11, 2008

Monday, February 4, 2008

Credit crunch

Paul Krugman has a short and wonderful column today outlining why we will most likely see a recession -- and he does it in a few words and one graph. See below:

So we get back to the idea of credit being most affected by "when lenders are no longer willing to lend, or borrowers are no longer willing to borrow" as an idea for the impending (in progress I would say) economic slowdown.

What we are really seeing at the present time is a Fed doing it's damnest to 'bail out' the banks, while the banks are continuing to tighten credit. So one might ask, 'where is all the newly printed money going?' To which I would answer shoring up bank balance sheets.

One must keep in mind that lenders are far from the light at the end of the tunnel when it comes to declaring all their losses both actual and forecast.

At the present time, lenders are facing potential losses from any and all of the following:

1) securities writedowns as credit ratings are downgraded on MBS's & CDO's

2) mortgage defaults in sub-prime, Alt-A AND Prime mortgages

3) 'jingle mail', or borrowers simply mailing in the keys rather than pay high payments

4) losses on rising home equity defaults

5) potential lawsuits for 'illegal lending'

Thus, with all the bad news yet to come out, the only thing banks are willing to do is lend on the 'sure thing' while shoring up balance sheets with wider spreads between Fed lending and customer borrowing.

I don't see this ending anytime soon.

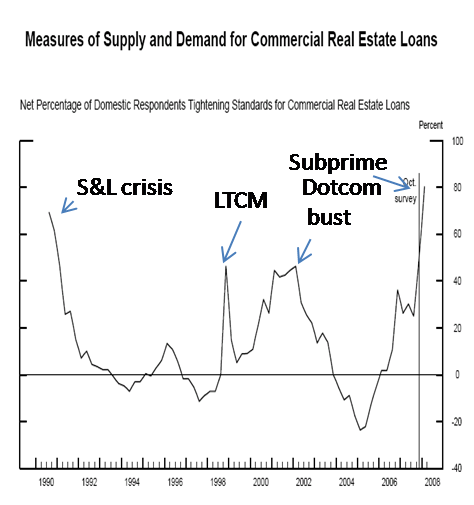

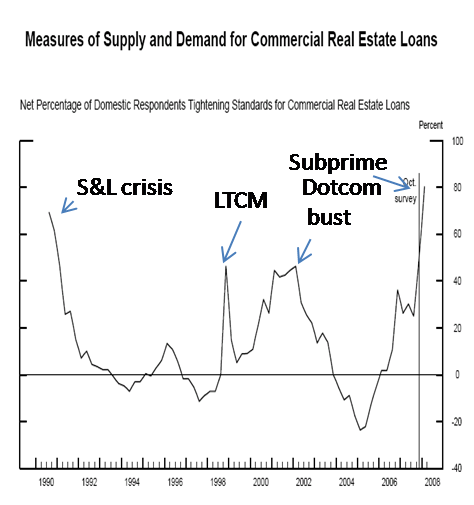

Meanwhile, out in the nonpolitical world (although everything is political these days), the new Federal Reserve senior loan officer survey shows an incredible credit crunch in progress — worse than the crunches following the S&L crisis, worse than the brief crunch when LTCM blew up, worse than the dotcom bust. This is pretty grim.

So we get back to the idea of credit being most affected by "when lenders are no longer willing to lend, or borrowers are no longer willing to borrow" as an idea for the impending (in progress I would say) economic slowdown.

What we are really seeing at the present time is a Fed doing it's damnest to 'bail out' the banks, while the banks are continuing to tighten credit. So one might ask, 'where is all the newly printed money going?' To which I would answer shoring up bank balance sheets.

One must keep in mind that lenders are far from the light at the end of the tunnel when it comes to declaring all their losses both actual and forecast.

At the present time, lenders are facing potential losses from any and all of the following:

1) securities writedowns as credit ratings are downgraded on MBS's & CDO's

2) mortgage defaults in sub-prime, Alt-A AND Prime mortgages

3) 'jingle mail', or borrowers simply mailing in the keys rather than pay high payments

4) losses on rising home equity defaults

5) potential lawsuits for 'illegal lending'

Thus, with all the bad news yet to come out, the only thing banks are willing to do is lend on the 'sure thing' while shoring up balance sheets with wider spreads between Fed lending and customer borrowing.

I don't see this ending anytime soon.

Friday, January 18, 2008

Volcker blames Fed for 'bubbles,' ...

I am old enough to barely remember the reality of the Volcker years fighting inflation. Certainly I remember double-digit interest rates and high unemployment rates. At the time I was too young and clueless to understand the dynamics of what was happening. Now, I see Volcker for the 'god' he was -- a central banker willing to force Americans to take their medicine and get better. I wonder what 'Helicopter Ben's' legacy will be...

Comment: Poor Ben, no wiggle room. Cut rates, kill the dollar, and probably not save the economy. Don't cut rates, watch the economy tank for sure, save the dollar (a little) for another day. Raise rates, give us the medicine we need to grow stronger in the future, and kill the economy while the lynch mobs form for you. What IS a central banker to do?

Volcker blames Fed for 'bubbles,' says it isn't in control

WASHINGTON (Reuters) — Former Federal Reserve Chairman Paul Volcker thinks the U.S. central bank is to blame for allowing bubbles to inflate asset markets, and says that current Fed chief Ben Bernanke is in a tough spot.

"I think Bernanke is in a very difficult situation," Volcker told the New York Times Magazine for a story it will run Sunday. The Times made the text available to the media in advance of publication.

"Too many bubbles have been going on for too long ... The Fed is not really in control of the situation," the Times quoted Volcker as saying, seemingly clear criticism of both Bernanke and his predecessor Alan Greenspan.

Comment: Poor Ben, no wiggle room. Cut rates, kill the dollar, and probably not save the economy. Don't cut rates, watch the economy tank for sure, save the dollar (a little) for another day. Raise rates, give us the medicine we need to grow stronger in the future, and kill the economy while the lynch mobs form for you. What IS a central banker to do?

Volcker chaired the Fed between 1979 until 1987, when he handed over the reins to Greenspan.

A slumping U.S. housing market following years of rampant price rises has sparked a global credit crunch and could tip the economy into a recession.

Critics blame the ultra-low interest rate policies of the final Greenspan years — when the U.S. central bank steered overnight federal funds rates to 1% and held them there for a prolonged period of time — for fueling the housing bubble.

Bernanke, who was also a Fed board governor between 2002 and 2005, inherited the problem to an extent.

Greenspan has long been criticized for being very aggressive in cutting interest rates when growth was threatened, but slower to raise them when it picked up and the risks flipped toward higher inflation.

Volcker, a towering man known widely as 'Tall Paul', is credited with breaking the back of rampant 1970s inflation by aggressively tightening monetary policy, for which he was greatly criticized in some quarters at the time.

"It's no fun raising interest rates," Volcker said.

Thursday, January 17, 2008

It’s official—CEOs are worried (and they should be...)

I guess we can add worried CEO's to the list of everyone else now worried by the tightening credit markets, crashing housing markets, dropping GDP and all that is going on.

My comment: What makes them think things will be limited to the first half of the year?

My Comment: I guess we can add this declining measure to the continual slide in housing starts, building permits, manufactuing activity, etc etc.

My comment: With the consumer tapped out, the housing piggy bank running dry, tightening credit for credit cards and auto loans, and HELOC's being scaled back unilaterally by banks, why might the consumer think we are in a slowdown?

My comment: Businesses continue to fight expanding competiton (from abroad) and rising prices by... lowering prices?

http://www.financialweek.com/apps/pbcs.dll/article?AID=/20080116/REG/165838966/1028/FRONTPAGE

It’s official—CEOs are worried

By Frank Byrt

January 16, 2008

Chief executives’ confidence in the U.S. economy has dropped to a seven-year low.

According to the latest survey of CEOs conducted by the Conference Board, inflation concerns and credit market uncertainties have chief executives predicting that it will be tough to maintain profitability for the first half of the year.

My comment: What makes them think things will be limited to the first half of the year?

Lynn Franco, director of the Conference Board’s consumer research center, said the credit crunch and increases in energy prices, along with the recent big write-offs by the nation’s largest banks, have spooked CEOs.

Indeed, the board’s measure of CEO confidence fell to 39 in the fourth quarter of 2007, down from 44 in the third quarter. The last time the index fell below 40 was in the final quarter of 2000, back when the U.S. was entering recession. A reading of more than 50 points reflects more positive than negative responses.

My Comment: I guess we can add this declining measure to the continual slide in housing starts, building permits, manufactuing activity, etc etc.

Only 16% of the CEOs surveyed said they expected general economic conditions to improve over the first half of the year. Their outlooks for their own industries are equally pessimistic: Only 17% anticipate any improvement during the next six months or so. In the previous CEO survey, 27% of the chief executives expected a recovery in their industries.

“Obviously what we’re picking up from the consumer and CEO surveys is the sense that they’re reacting as if we are in a severe slowdown,” said Ms. Franco. “So they’re cautious looking ahead.”

My comment: With the consumer tapped out, the housing piggy bank running dry, tightening credit for credit cards and auto loans, and HELOC's being scaled back unilaterally by banks, why might the consumer think we are in a slowdown?

“We’ve not gotten any feedback…suggesting a turnaround in next quarter or so,” she added. “There will be more negative news than positive for the next several months.”

The erosion in CEO confidence coincides with a marked decline in GDP growth, which slowed to an estimated 1.5% to 2% in the fourth quarter, down from the 5% growth in the third quarter. “It’s very noticeable,” Ms. Franco said, “like going from 100 miles per hour to 45.”

Although CEOs said that they’re seeing some price increases from their suppliers, in general they have been reluctant to pass on any significant price increases to their customers, she said. According to the survey, the majority of CEOs expect changes in their businesses’ selling prices in 2008, but just 9% are anticipating price increases in excess of 10%. More ominously, about 13% said they plan price decreases and 4% foresee no change.

My comment: Businesses continue to fight expanding competiton (from abroad) and rising prices by... lowering prices?

“We’re seeing growing concern and caution,” noted Ms. Franco. “A lot of big decisions, including hiring decisions, may get put on hold until things are clearer.”

http://www.financialweek.com/apps/pbcs.dll/article?AID=/20080116/REG/165838966/1028/FRONTPAGE

Wednesday, January 16, 2008

Ben Bernanke, meet Gary Crittenden

When Ben Bernanke was appointed Chairman of the Fed, I remarked to several people how I wouldn't take that job for all the money they could throw at me. At the time I fully expected that the excess of 'Easy Al' Greenspan would come home to haunt us and eventually, Bernanke would be forced to choose between killing the economy, or killing the dollar. That was well before the 'credit crisis' hit.

Now we have a whole new set of problems that present themselves to the current Chairman. Most significantly, it appears the 'conundrum' that Greenspan faced in being unable to affect the long end of the yield curve in the last years of his term will now reverse itself for Mr. Bernanke. Helicopter Ben may find that no matter how many dollars he drops, the credit crisis he inherited thru the hangover of Greenspans excess liquidity will leave him unable to affect the short end of the curve. In other words, dropping rates in an attempt to save the economy may not translate into lower rates for borrowers.

With the market clamoring for lower rates to save it, and banks signaling their intention to tighten credit ans raise rates, what is a Central Banker to do?

Now we have a whole new set of problems that present themselves to the current Chairman. Most significantly, it appears the 'conundrum' that Greenspan faced in being unable to affect the long end of the yield curve in the last years of his term will now reverse itself for Mr. Bernanke. Helicopter Ben may find that no matter how many dollars he drops, the credit crisis he inherited thru the hangover of Greenspans excess liquidity will leave him unable to affect the short end of the curve. In other words, dropping rates in an attempt to save the economy may not translate into lower rates for borrowers.

With the market clamoring for lower rates to save it, and banks signaling their intention to tighten credit ans raise rates, what is a Central Banker to do?

An Effort to Stem Losses at Citigroup Produces a Renewed Focus on Risk

By FLOYD NORRIS

Published: January 16, 2008

Ben Bernanke, meet Gary Crittenden. While you’re easing credit, he is tightening it.

The Federal Reserve’s open market committee, headed by Mr. Bernanke, is widely expected to cut interest rates by at least half a percentage point when it meets at the end of January. The committee’s intent will be to ease credit and help the economy.

Mr. Crittenden, the chief financial officer of Citigroup, had a different message on Tuesday, as Citi disclosed an $18.1 billion write-down. He told analysts that Citi was raising rates on credit cards and tightening the amount of credit it would extend. Asked by an analyst whether credit card lending was an area where Citi might want to “pull back or increase pricing,” he responded, “All of the above.”

He said the most attention was being paid to credit card holders in five states that accounted for two-thirds of Citi’s credit card losses: Arizona, California, Florida, Illinois and Michigan.

Citi is also reducing the amount of residential mortgage loans it is making. In the fourth quarter, it lent $29.5 billion to American homeowners, down 16.4 percent from the same period in 2006. It was the lowest total for any quarter since the first three months of 2005.

Citi is not alone. While the tighter credit market has not stopped credit-worthy individuals or companies from obtaining loans, it has made loans more expensive for many of them, and left those with the greatest need for cash far less able to obtain it.

“They are parceling out credit with a keen eye on the balance sheet,” said John Garvey, the head of the financial services advisory group at PricewaterhouseCoopers. “There is a flight to quality and a renewed focus on risk.”

That trend has directly countered the Fed’s efforts. Compared with a year ago, before the Fed began to lower the federal funds rate — the rate at which banks can borrow — conventional 30-year mortgages are lower, but so-called jumbo mortgages of more than $417,000 are higher.

“Over the second half of last year, the fed funds rate fell by 100 basis points,” or a full percentage point, said Robert Barbera, the chief economist of ITG. “But almost any measure saw rising interest rates and tightened credit availability for many borrowers. The Fed needs to drive the fed funds rate down dramatically to get interest rates for the public and corporations to go down rather than up.”

Citi and its rivals are reacting to a period when credit standards were very loose, and many poor loans were made, leading to the current round of multibillion-dollar write-offs.

One measure of that came in a detail of the write-downs Citi announced. At the end of September, it put the value of some mortgage securities it owned at $2.7 billion. It had purchased those securities intending to repackage them as part of collateralized debt obligations and sell securities in the C.D.O.’s to investors.

The collapse of the C.D.O. market made such sales impossible, and Citi still owns the securities. But it has decided they are worth about 5 percent of what they had been, and has taken a write-down of $2.6 billion.

The write-downs taken by Citi, and by some rivals, are based on assumptions about how bad the mortgage and home-price problem will become. If those assumptions turn out to be too pessimistic, then the assets written down Tuesday will turn out to have greater value.

On the other hand, if the assumptions are too optimistic, more write-downs may come.

Many of the assumptions were not disclosed, but Mr. Crittenden did say that Citi was assuming that home prices would decline 6.5 percent to 7 percent in 2008, and by a similar amount in 2009. He did not say what Citi was assuming for later years.

Citi’s shares fell $2.12, to $26.94, a 7.3 percent loss that left the price less than half its level of a year ago.

That is bad news for investors for a reason other than the obvious one. The company plans to raise $14.5 billion by selling convertible preferred stock, with a 7 percent annual coupon. Of that, $2 billion will go to the public and the rest to a group of investors, including the government of Singapore and Sanford I. Weill, Citi’s former chief executive.

The conversion price of that new issue is to be 20 percent over the market price of Citi stock, but Citi refused to say over what period the market price would be calculated. The lower the price, the more dilution will be produced for existing shareholders.

Citi also reduced its dividend by 41 percent, but the payout remains high compared to the share price.

At 32 cents a quarter, the current annual yield is 4.75 percent, a quarter-point above the interest rate Citi pays on its “ultimate savings account.” A buyer of the stock gets a higher level of income, with better tax treatment and the possibility of capital gains.

But the share buyer also faces the possibility of capital losses. Perhaps investors recall what happened in 1991. On Jan. 15 of that year, exactly 17 years before Tuesday’s announcement, the dividend of Citicorp, a Citigroup predecessor, was cut 45 percent amid worries over losses from commercial real estate and loans to highly leveraged companies.

“I’m embarrassed,” Citi’s chief executive, John Reed, said then, of the dividend reduction. “I did not want to do it.”

Nine months later, the dividend was eliminated, and the stock fell well below the January price. “We clearly have picked up more, or at least our fair share of problems,” Mr. Reed said. The dividend was not restored until 1994.

Only two months ago, Citigroup arranged for its first big capital infusion of this cycle, with the government of Abu Dhabi investing $7.5 billion. It is guaranteed an 11 percent yield on that security, but only for a few years. Then the security will convert into common at a price that will vary based on Citi’s share price at the time. If Citi’s stock is at Tuesday’s level, Abu Dhabi’s $7.5 billion investment will be converted into common stock worth just $6.3 billion.

If all the bad news is out, and Citi can maintain the new dividend indefinitely, then the current share price will probably look amazingly cheap in a few years. The fact it has fallen so far shows how worried investors are that things can get worse

Tuesday, January 15, 2008

It's ALL Sub-Prime now!

Way back in the early days of the "sub-prime" crisis,and right about the time Bear Stearns funds started blowing, I began sharing my thoughts with those I knew about where housing was headed. There were plenty of 'colorful' adjectives I used in my descriptions, but the term 'unmitigated disaster' was one I found myself often repeating. Well folks, it's only going to get worse. The issues now being 'covered' by the press are the same ones I was looking at back in the 'old days'. And nothing is going to make them any better. Here's one of them:

Comment: Many of these 'prime' borrowers got their 'prime' status by taking out loads of credit, re-fi'ing their homes, and making those minimum payments 'on-time', allowing them to get yet more credit. many of these 'prime' borrowers will be nothing near their 'prime' credit scores soon.

Comment: Bank of America's purchase of Countrywide at an assumed 'discount' of 66% of book value assumes that CFC actually has a book value. As one of the largest lenders of Option ARMS, and a holder of billions in 2nd mortgages with LTV (loan to value) levels in excess of 90%, much of this book value is already worthless. I would have thought BAC would have learned from their fist investment in CFC but I guess "stupid is as stupid does" may still apply here.

Comment: And this is the root of the housing issue. "Liar loans". While we have heard this term already, I predict you will be hearing a lot more about it as more loans blow up.

Comment: And where were the 'checks and balances'? Or I guess one might as IF there were checks and balances.

Comment: As sub-prime became less of an option, Option Arms became the new sub-prime sale.

Comment: Why should one be surprised. Many in the mortgage industry were not. Certainly others of us looked at houses increasing in price every year and questioned the sanity of it all. Viewing the growth in these 'teaser rate' loans, it wasn't hard for many of us to see it was all based on funny money.

Comment: At the same time, lenders were now able to 'off-load' risk into securitized pools of mortgages. No longer was there a need for strong oversight, as lenders no longer owned the loans. And even with recourse terms built into them, the assumption was that few loans would fail. As these early loans performed as expected, the sub-slime segment continued to grow and standards continued to deteriorate. It all looked great -- till it didn't -- as housing prices peaked and buyers evaporated.

Comment: That last paragraph is an AMAZING number to comprehend. What is the probablity that 100% of those loans will default if they had to double their incomes just to get into the homes?

Adjustable loans spur new worries

Defaults are climbing among option ARMs. Many require minimal monthly payments and no proof of income.

By E. Scott Reckard, Los Angeles Times Staff Writer

January 14, 2008

The no-worries lending that inflated the housing bubble is resulting in a flood of soured option-ARM loans, adjustable-rate mortgages that allow borrowers to pay so little every month that their loan balances rise rather than fall, sometimes sharply.

Numbers from industry trackers suggest that these borrowers -- most of whom boast respectable and often top-tier credit scores and appear to have substantial incomes and home equity -- are starting to create a second tide of defaults for lenders swamped by the meltdown in sub-prime loans made to people with bad credit or overstretched finances.

Comment: Many of these 'prime' borrowers got their 'prime' status by taking out loads of credit, re-fi'ing their homes, and making those minimum payments 'on-time', allowing them to get yet more credit. many of these 'prime' borrowers will be nothing near their 'prime' credit scores soon.

Option ARM delinquencies are at double-digit levels in many areas of California, including the Inland Empire.

Calabasas-based Countrywide Financial Corp., the top option ARM lender, will be hit hard. Already reeling from the sub-prime mess, Countrywide was rescued from possible bankruptcy last week by Bank of America Corp., which agreed to acquire it for about $4 billion.

Comment: Bank of America's purchase of Countrywide at an assumed 'discount' of 66% of book value assumes that CFC actually has a book value. As one of the largest lenders of Option ARMS, and a holder of billions in 2nd mortgages with LTV (loan to value) levels in excess of 90%, much of this book value is already worthless. I would have thought BAC would have learned from their fist investment in CFC but I guess "stupid is as stupid does" may still apply here.

The option ARM trouble stems from the loose lending practices that inundated the sub-prime business. Loans often were granted on the basis of stated income, not proof of a borrower's income, giving rise to their nickname, "liar's loans."

"This is not a sub-prime crisis. This is a stated income crisis," said Robert Simpson, chief executive of Investors Mortgage Asset Recovery Co. in Irvine, which works with lenders, insurers and investors to recover losses related to mortgage fraud.

Comment: And this is the root of the housing issue. "Liar loans". While we have heard this term already, I predict you will be hearing a lot more about it as more loans blow up.

Option ARMs present borrowers with a choice every month: pay the interest due and some of the principal; pay interest only, leaving the loan balance untouched; or pay less than the interest due, making the loan balance rise.

After a specified time, typically five years, the options disappear and regular payment obligations kick in, often at a level two or more times the initial minimum. This jolt can occur after only three years if the borrower has been making the lowest payments and the balance rises high enough.

Traditionally, good candidates for stated-income option ARM loans were self-employed professionals, small-business owners and salespeople with complicated finances and fluctuating earnings. But many other people received them in recent years.

Simpson said loan officers routinely inflated earnings of workers with regular paychecks. On some written requests to confirm a borrower's employment, officers would specify that an employer should not provide a salary figure, he said.

Comment: And where were the 'checks and balances'? Or I guess one might as IF there were checks and balances.

Now the delinquencies are piling up.

The percentage of option ARMs with payments behind by at least 60 days in California is in double digits in the Inland Empire, San Diego County, Santa Barbara County, Sacramento, Salinas and Modesto, according to data provided to The Times by mortgage researcher First American Loan Performance.

The more recent loans appear to be faring the worst, reaffirming the conclusion that lending standards had become overly lax throughout the mortgage industry in the middle of this decade, as competition for fewer good loans intensified amid skyrocketing home prices.

Comment: As sub-prime became less of an option, Option Arms became the new sub-prime sale.

In Yuba City, north of Sacramento, 15% of option ARMs made in 2005 were delinquent at the end of October, the Loan Performance tally showed, and in Stockton-Lodi the delinquency rate on option ARMs from both 2005 and 2006 was over 13%.

"It is astonishing how fast the credit deterioration has occurred," said Paul Miller, an analyst with Friedman, Billings, Ramsey & Co. who follows the savings and loans that specialize in these mortgages. "It took me and everybody else by surprise."

Comment: Why should one be surprised. Many in the mortgage industry were not. Certainly others of us looked at houses increasing in price every year and questioned the sanity of it all. Viewing the growth in these 'teaser rate' loans, it wasn't hard for many of us to see it was all based on funny money.

Miller said Downey Financial Corp. was "the canary in the coal mine." The Newport Beach S&L has specialized in making option ARMs since the 1980s and keeps them as investments. Option ARMs make up about three-quarters of Downey's loan portfolio, with most of the rest being similar loans that allow interest-only payments during the first five years but don't allow the loan balance to rise.

Miller thought Downey had shown prudence in cutting back on lending in 2006, when home prices stopped rising and competition intensified from option ARM newcomers such as Countrywide and IndyMac Bancorp of Pasadena.

But a key indicator of loan troubles -- the ratio of nonperforming assets to total assets -- shot up from 0.55% to 3.65% at Downey over the last year, with the dud loans on Downey's books growing by $80 million in November, Miller said. That number, disclosed last month, was larger than the entire amount of non-performers Downey had a year earlier.

The quality of option ARMs appears to have deteriorated quickly when Wall Street began buying them to create mortgage bonds in the middle of this decade, drawing IndyMac, Countrywide and others into the business, Miller said.

Comment: At the same time, lenders were now able to 'off-load' risk into securitized pools of mortgages. No longer was there a need for strong oversight, as lenders no longer owned the loans. And even with recourse terms built into them, the assumption was that few loans would fail. As these early loans performed as expected, the sub-slime segment continued to grow and standards continued to deteriorate. It all looked great -- till it didn't -- as housing prices peaked and buyers evaporated.

Loan Performance's study, which looked at loans bundled up by lenders and Wall Street firms to back mortgage bonds, found that 8.8% of such option ARMs made nationally in 2005 were 60 days or more in arrears as of Oct. 31.

In California, the 60-day delinquency figure for securitized 2005 option ARMs was 9.5%, compared with only 2.1% of the option ARMs from 2003.

Falling home prices and exaggerated appraisals are exposing the risks of stated-income ARMs, experts say. And many option ARMs were done with stated income during the boom. "When you combine one of the riskiest loans -- the option ARM -- with one of the riskiest loan features -- stated income -- it's not exactly a model for safety," said Redwood City, Calif., mortgage broker Steven Krystofiak, president of the Mortgage Brokers Assn. for Responsible Lending, who has testified to the Federal Reserve about high-risk loans.

"Yet they were extremely popular in 2004, 2005 and 2006, and some people were telling borrowers and investors they were safe."

Stated-income loans made during the housing boom have proved to be riddled with exaggeration, according to the Mortgage Asset Research Institute in Reston, Va., which investigates lending fraud.

The institute said one of its customers checked 100 stated-income loans against tax documents and found that nine in 10 of them overstated income by at least 5%.

"More disturbingly, almost 60% of the stated amounts were exaggerated by more than 50%," the institute reported, saying the mortgages clearly deserve their "liar's loan" handle.

Comment: That last paragraph is an AMAZING number to comprehend. What is the probablity that 100% of those loans will default if they had to double their incomes just to get into the homes?

Among critics of recent practices in granting option ARMs is Herbert Sandler, former chief executive of Golden West Financial Corp. in Oakland. Sandler's World Savings, now part of Wachovia Corp., was among California S&Ls that pioneered the use of option ARMs in the 1980s.

World Savings was known for making stated-income option ARMs, often to borrowers with lower credit scores than other lenders would permit. But unlike newcomers to the business, World limited its loans to 80% of the property's value unless the loan was insured, conducted its own conservative appraisals -- and kept the loans on its own books so it retained the risk of loss. Defaults were few.

The new wave of lenders "destroyed that loan," Sandler said, "and that's what disgusts me."

The problem created by adjustable-rate mortgages made to borrowers with good credit is attracting attention in Washington, where policymakers are trying to restore stability to the financial system.

Treasury Secretary Henry M. Paulson Jr. told a meeting of securities analysts in New York last week that mortgage lenders and bill collectors, who have agreed to a plan to fast-track loan modifications for sub-prime borrowers, should adopt "a systematic approach for adjustable rate mortgages other than sub-prime if it will benefit homeowners and investors."

Monday, January 14, 2008

Europeans Cut & run on Equity Funds

The funny part of all this is... The EU zone is NOT experiencing quite as big a mess as we are...Maybe they know something American's don't want to admit?

Data show huge withdrawals

By Steve Johnson

Published: January 14 2008 02:00

European asset managers have suffered a "complete collapse" in support for equity funds amid a "sea of redemptions" for almost all asset classes, according to fresh data from Lipper Feri Fund Market Information.

European investors withdrew a net €26bn (£20bn, $38bn) from collective vehicles in November, Feri found. Stripping out ultra-safe, low margin, money market funds, net redemptions ballooned to €45bn during the month.

This came on top of net outflows of €79bn in the three months to September as investors withdrew money en masse in the wake of the market chaos rippling out from the US subprime mortgage market fiasco, by far the worst quarterly data since Feri began tracking the industry in 2002.

Equity funds suffered net outflows of €25bn in November as a 7 per cent slide in equity valuations "sent withdrawals spiralling into the post-millennium record book", according to Feri. Exchange-traded funds investing in emerging markets were just about the only bright spot, with even erstwhile popular China funds seeing outflows.

Fixed-income funds "continued to battle for survival" against the attractions of deposit accounts, Feri said, as a further €10bn was withdrawn, taking total net outflows for the 11 months to November to €77bn.

The enhanced money market funds sector continued to implode, losing a further €6bn to add to withdrawals of €33.8bn in the third quarter of 2007, while real estate and mixed-asset vehicles also haemorrhaged money.

The November sell-off was evident virtually across Europe. Only a handful of smaller eastern European markets managed positive flows.

Once market falls are factored in, total assets under management across the European fund industry, excluding money market and funds of funds, slumped 4.5 per cent to €4,399bn. Assets managed by UK funds tumbled 5.9 per cent to €585bn, while the French funds industry contracted 4.5 per cent and that of Italy by 3.6 per cent.

Deutsche/DWS was the best performing group in November, attracting net inflows of €1.6bn thanks to its range of ETFs.

Subscribe to:

Posts (Atom)