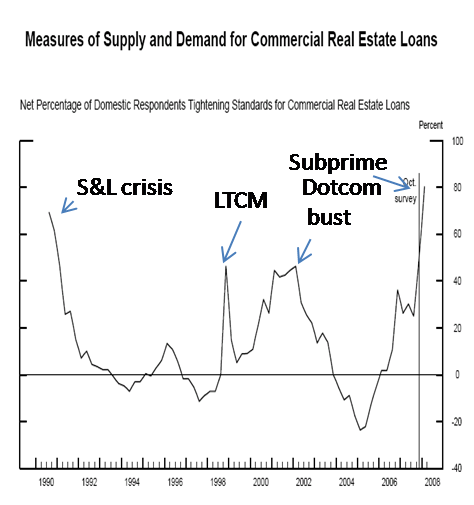

Meanwhile, out in the nonpolitical world (although everything is political these days), the new Federal Reserve senior loan officer survey shows an incredible credit crunch in progress — worse than the crunches following the S&L crisis, worse than the brief crunch when LTCM blew up, worse than the dotcom bust. This is pretty grim.

So we get back to the idea of credit being most affected by "when lenders are no longer willing to lend, or borrowers are no longer willing to borrow" as an idea for the impending (in progress I would say) economic slowdown.

What we are really seeing at the present time is a Fed doing it's damnest to 'bail out' the banks, while the banks are continuing to tighten credit. So one might ask, 'where is all the newly printed money going?' To which I would answer shoring up bank balance sheets.

One must keep in mind that lenders are far from the light at the end of the tunnel when it comes to declaring all their losses both actual and forecast.

At the present time, lenders are facing potential losses from any and all of the following:

1) securities writedowns as credit ratings are downgraded on MBS's & CDO's

2) mortgage defaults in sub-prime, Alt-A AND Prime mortgages

3) 'jingle mail', or borrowers simply mailing in the keys rather than pay high payments

4) losses on rising home equity defaults

5) potential lawsuits for 'illegal lending'

Thus, with all the bad news yet to come out, the only thing banks are willing to do is lend on the 'sure thing' while shoring up balance sheets with wider spreads between Fed lending and customer borrowing.

I don't see this ending anytime soon.

No comments:

Post a Comment