Researchers predict a 'generational' dive in housing demand and say it could cause a major price downfall.

By Lew Sichelman, United Feature Syndicate

February 10, 2008

WASHINGTON -- The common perception among economists is that the current housing mess will be a relatively short-term affair that should see a return to normalcy within the next few years.

But, according to a new study by two USC researchers, problems of greater proportion lie just ahead. They call it the "generational housing bubble" and maintain that it will be fueled by the same baby boomers who have been bidding up prices since 1970 as they moved up the housing ladder.

Now, 78 million boomers are about to enter their twilight years when homeowners tend to become sellers rather than buyers. And as a result, the USC duo expects there will be "many more homes available for sale than there are buyers for them."

As the elderly become more numerous than the young, and shift into seller mode, the researchers postulate, the market imbalance could come quickly around 2011, causing housing prices to fall.

Only time will tell whether the projections by Dowell Myers, a professor of urban planning and demography in USC's School of Policy, Planning and Development, and Sungho Ryu, a doctoral candidate at the school and an associate planner with the Southern California Assn. of Governments, will come to pass.

After all, not all seniors retire or sell their homes and move to smaller places. Many prefer to age in place and live in their own homes. But eventually, as they die off, most of their homes will come on the market.

Myers and Ryu's foreboding prophecies bring to mind a 1989 study by a pair of Harvard economists, who predicted a 47% decline in housing prices during the 1990s because boomers would stop buying as they aged. Housing-industry economists lambasted that forecast as pure poppycock, and it eventually went up in smoke.

The USC researchers don't expect the generational correction to begin until 2011 or so. That's just about the time the most pessimistic prognosticators suggest the U.S. market will return to normal after five years or so on the rocks.

But it's also when the first wave of boomers reaches age 65, the traditional dividing point between seniors and working adults. And once that tipping point is reached, Myers and Ryu say, they will put more houses up for sale than the market will be able to absorb.

The researchers base much of their theory on the historic relationship between age and housing demand. For most of the American life span, the rates of buying and selling remain closely related because those who sell one house typically buy another. When people enter their late 50s and early 60s, as the leading wave of baby boomers has now done, buying and selling are in balance. When they reach their mid-60s, though, sellers start to outnumber buyers. And when they hit their 70s, sellers dominate.

People continue to buy homes after that age. But once they hit that benchmark, the number of sellers begins to exceed the number of buyers. Once they reach 75, they are three times as likely to be sellers than buyers. And at 80 and above, they are nine times more likely to be sellers.

Myers and Ryu project that the ratio of those age 65 and over to people ages 25 to 64 will surge 30% in the decade between 2010 to 2020 and 29% more in the 2020s, altering the balance between buyers to sellers for the foreseeable future.

They say the supply of houses on the market will be dominated by the actions of aging homeowners "who have little ability to postpone" their need to sell and retire from the housing market. They also caution that boomers facing age-related issues "could flood the market with excess supply."

If values decline, as the researchers suspect they will, boomers who remain owners will suffer because their equity will fall, shrinking what for many is their retirement savings.

If there is a positive aspect to Myers and Ryu's dire predictions, it's that the coming generational bubble will be a rolling one that won't affect all housing markets at the same time. And in some states, the sell-off will come later rather than sooner. Regional differences may be sharp.

Historically, seniors don't become net sellers in Arizona, Florida and Nevada until they reach 75. But the opposite is true in 13 other states -- Alaska, California, Connecticut, Illinois, Indiana, New Jersey, New York, Maryland, Massachusetts, Michigan, Minnesota, Ohio and Rhode Island. In those states, the crossover starts at age 55.

Lew Sichelman can be reached at lsichelman@aol.com.

Monday, February 11, 2008

Monday, February 4, 2008

Credit crunch

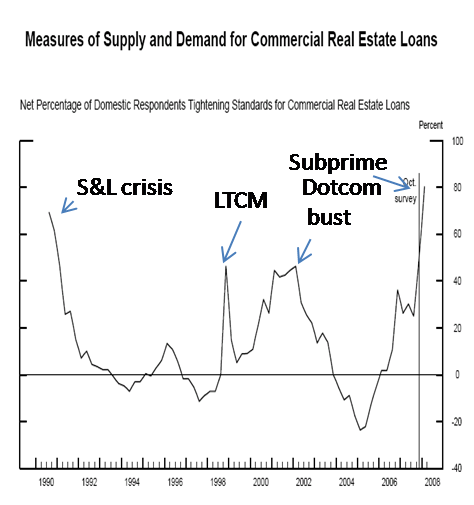

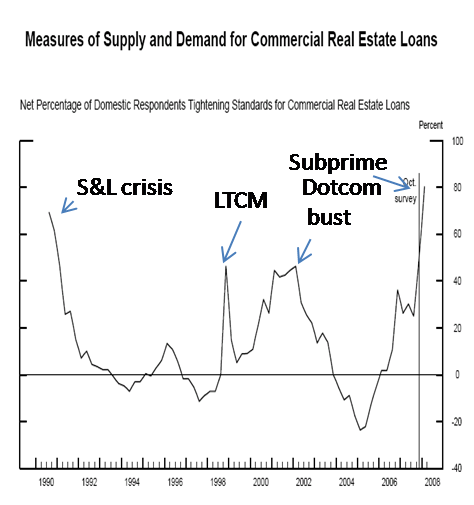

Paul Krugman has a short and wonderful column today outlining why we will most likely see a recession -- and he does it in a few words and one graph. See below:

So we get back to the idea of credit being most affected by "when lenders are no longer willing to lend, or borrowers are no longer willing to borrow" as an idea for the impending (in progress I would say) economic slowdown.

What we are really seeing at the present time is a Fed doing it's damnest to 'bail out' the banks, while the banks are continuing to tighten credit. So one might ask, 'where is all the newly printed money going?' To which I would answer shoring up bank balance sheets.

One must keep in mind that lenders are far from the light at the end of the tunnel when it comes to declaring all their losses both actual and forecast.

At the present time, lenders are facing potential losses from any and all of the following:

1) securities writedowns as credit ratings are downgraded on MBS's & CDO's

2) mortgage defaults in sub-prime, Alt-A AND Prime mortgages

3) 'jingle mail', or borrowers simply mailing in the keys rather than pay high payments

4) losses on rising home equity defaults

5) potential lawsuits for 'illegal lending'

Thus, with all the bad news yet to come out, the only thing banks are willing to do is lend on the 'sure thing' while shoring up balance sheets with wider spreads between Fed lending and customer borrowing.

I don't see this ending anytime soon.

Meanwhile, out in the nonpolitical world (although everything is political these days), the new Federal Reserve senior loan officer survey shows an incredible credit crunch in progress — worse than the crunches following the S&L crisis, worse than the brief crunch when LTCM blew up, worse than the dotcom bust. This is pretty grim.

So we get back to the idea of credit being most affected by "when lenders are no longer willing to lend, or borrowers are no longer willing to borrow" as an idea for the impending (in progress I would say) economic slowdown.

What we are really seeing at the present time is a Fed doing it's damnest to 'bail out' the banks, while the banks are continuing to tighten credit. So one might ask, 'where is all the newly printed money going?' To which I would answer shoring up bank balance sheets.

One must keep in mind that lenders are far from the light at the end of the tunnel when it comes to declaring all their losses both actual and forecast.

At the present time, lenders are facing potential losses from any and all of the following:

1) securities writedowns as credit ratings are downgraded on MBS's & CDO's

2) mortgage defaults in sub-prime, Alt-A AND Prime mortgages

3) 'jingle mail', or borrowers simply mailing in the keys rather than pay high payments

4) losses on rising home equity defaults

5) potential lawsuits for 'illegal lending'

Thus, with all the bad news yet to come out, the only thing banks are willing to do is lend on the 'sure thing' while shoring up balance sheets with wider spreads between Fed lending and customer borrowing.

I don't see this ending anytime soon.

Subscribe to:

Comments (Atom)